Market Brief

See real-time quotes provided by our partner.

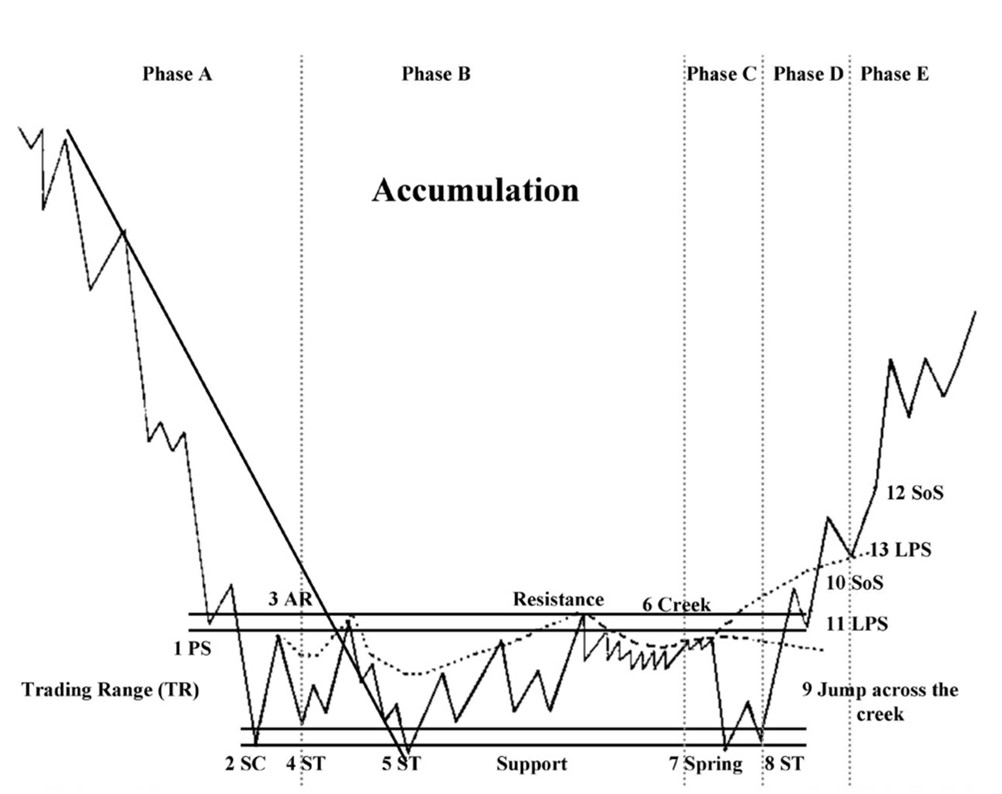

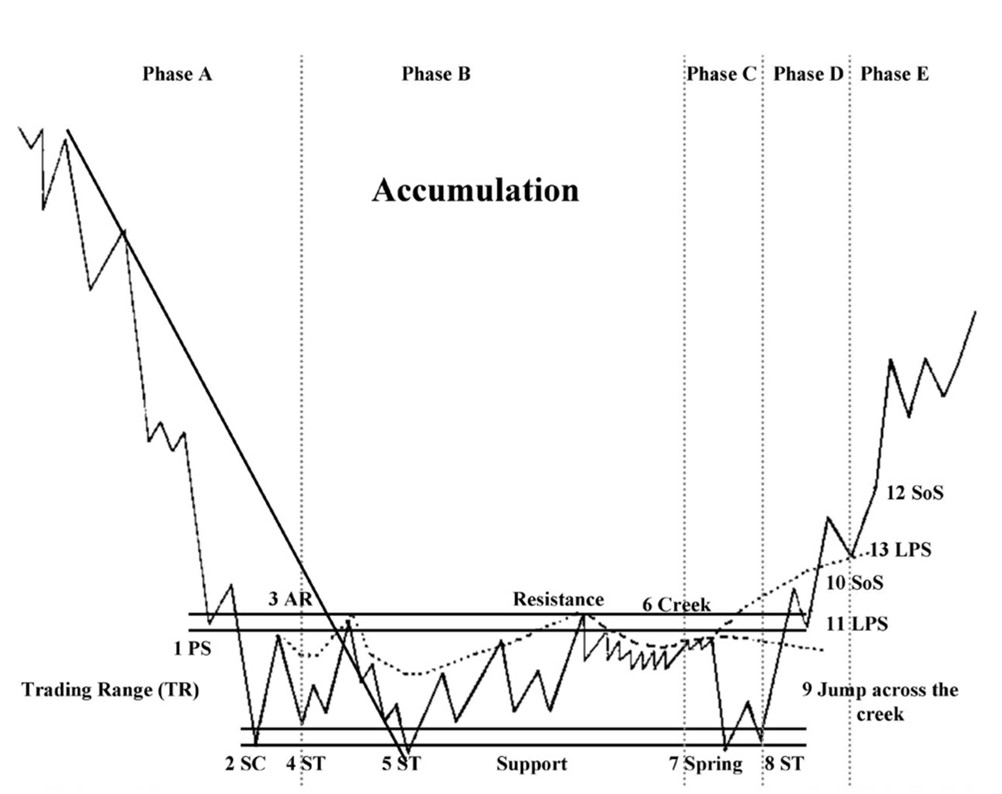

The euro is moving off its recent lows having found the 1.0500 a strong magnet yesterday. Today’s lift is on the back of French Flash GDP which came in worse than expectations for the most recent reading but was revised higher for the previous readings. Also supporting the single currency was news around French CPI and much better than expected German import prices. In yesterday’s wrap I highlighted on the intraday chart a potential bottoming pattern which I believe was an accumulation pattern before a pop higher. This is not to say the euro is out of the downtrend but as profits are taken and positions squared before the coming FOMC meeting in early May, we should expect some buyers to come in, even if it’s just hedging flows.

My personal view is that the EURUSD is in phase C and should we get back above the 1.05800 and close on the intraday chart, an expansion of this range through 1.0600 up towards 1.0800 could be on the cards.

Benchmark yields from the USA, UK, Germany, and Japan highlight the macro ideas of being long the US dollar against everything else. So any pullback in the EURUSD towards 1.0800 should in my opinion be considered a counter trend move. Long term US inflation expectations are for the 3% to be the new normal, so the market has basically priced that in, and then as rates approached 3%, we can see they backed off. This has given the euro and pound a little bit of room to manoeuvre.

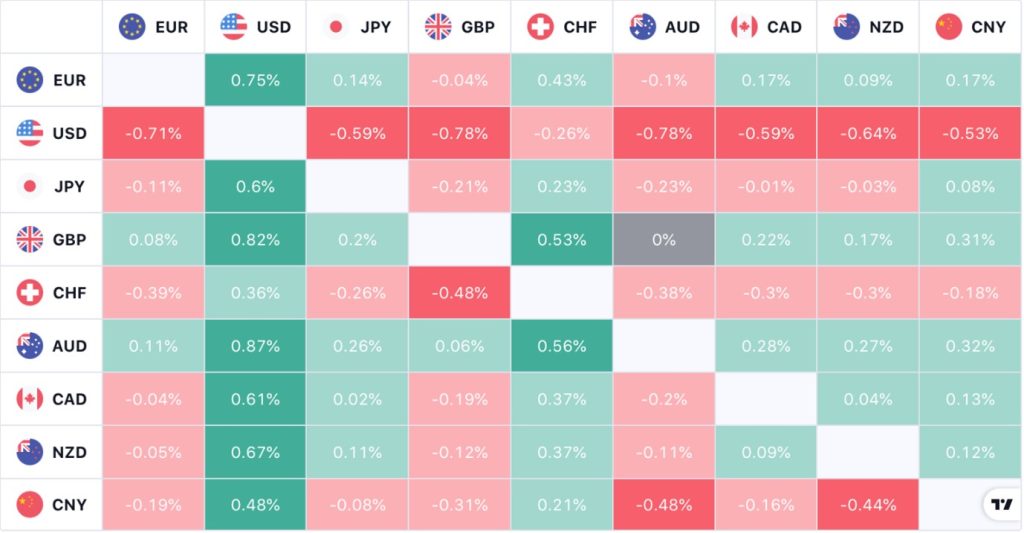

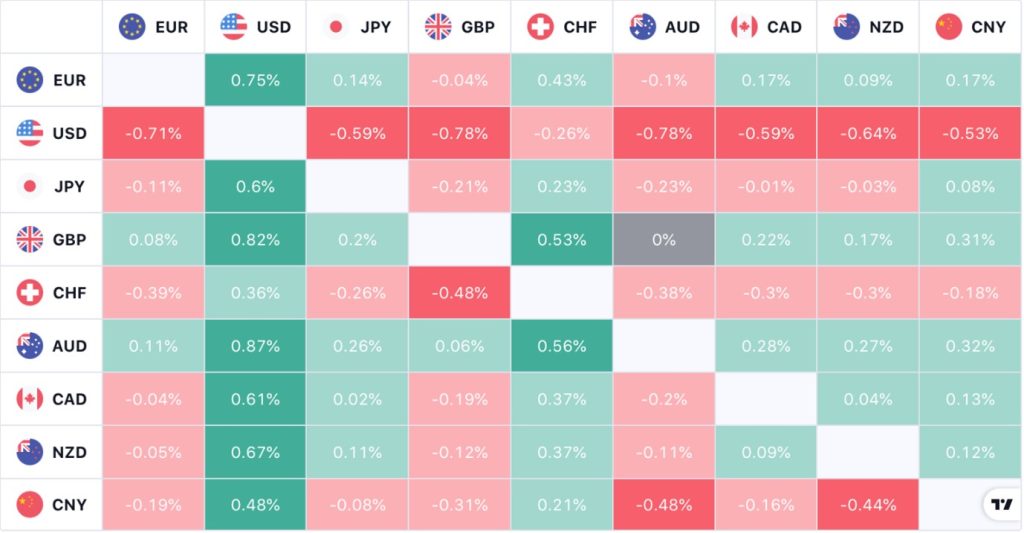

It has been a while since the US dollar was the weakest relative to the other major currencies we follow. The Swiss franc and Japanese yen are also weaker today, so flows from the safe havens towards more riskier assets should help keep pushing equities higher.

See real-time quotes provided by our partner.

The US dollar index smashed through the Fib extension that I had been calling for and potentially finished in a climactic top. Meaning a pullback to a level of support and possible value area is now likely at the completion of this 5-wave impulsive move. Impulsive moves do also tend to carry on going for longer than expected, so I am definitely not suggesting we sell this top today, but to be aware that we could be reverting to the mean at least.

See real-time quotes provided by our partner.

In the overnight session the Hang Seng and Shanghai Stock Exchange were up 3.40% & 2.41% respectively and in the globe session the Nasdaq is up 3.40%. The two largest components in the tech index are going to lead the Nasdaq higher after Apple’s Q2 earnings report came in better than expected, with great services revenue and a $90billion stock buyback. Microsoft was also trading higher yesterday after their Activision buyout offer was approved by shareholders in the game development company.

The main economic data comes out in the US session where get more info around the US personal spending and income data, plus a Chicago PMI and revision to the University of Michigan’s consumer sentiment and inflation expectations.

Next week starts off with the UK and China on a bank holiday so early flows should be limited and the market relatively quiet.

See real-time quotes provided by our partner.

The rejection of the $1880/oz level in gold yesterday speaks to the US dollar topping out and possible profit taking from the elevated levels. The price action in the yellow metal has now completed a range expansion and is pushing back into the mean of that range, highlighted in the grey box. If as I suspect we get a rejection of $1927/oz level, I’ll be looking for a larger move to the daily 200-period moving average. If however price closes back above the 9-period average today, there is a reason to then start looking for further upside as recent price action pushed the limit to the downside Bollinger band and gold is above the 200-period average indicating long term strength.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.