Sentiment towards a number of the major currencies is starting to reach the euphoric level, which could be a warning that the US dollar long trade may be either warming up or coming to an end. Now is a great time to check out how traders feel about some of the majors, as they look for contrarian trading signals via sentiment readings.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment bias amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking point and big moves may be nearing.

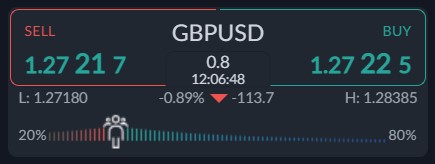

GBPUSD – Euphoric skew

According to the ActivTrader Market Sentiment tool traders a large majority of traders are now bullish towards sterling, despite the index crashing through the 1.2800 support area at the start of the week.

The ActivTrader Market Sentiment tool shows that 80 percent of traders are expecting more upside in the British currency. Given the bullish bias, sentiment is basically warning that more downside is coming.

I think the technicals are very good for a rebound. Couple this with the bullish sentiment bias, I think that retail is probably right about the direction, but they are undergoing one hell of a squeeze right now.

EURUSD – Still Bullish

The ActivTrader market sentiment tool shows that 73 percent of traders are bullish towards the EURUSD, following its recent large price drop towards the 1.0700 price region earlier this week.

Traders are still expecting more gains, with 73 percent of traders bullish according to the ActivTrader platform. Given that retail traders are usually on the wrong side of the trade, this is either a turning or continuation point for the euro’s downtrend.

In order for the bulls to be right, we really need to see the EURUSD pair recover towards the 1.0900 level. This would probably signal that the worst is over for the single in the short to medium-term.

US DOLLAR INDEX – Overheated

Market sentiment towards the US dollar is becoming more bearish, which is not very surprising given that the US political situation, and that typically benefits other currencies, however, this is not the case with the greenback under the Biden Presidency.

The ActivTrader market sentiment tool showing that some 85 percent of traders currently bearish towards the world’s leading currency, meaning that retail is on the whole very downbeat on the buck.

I think that the current sentiment is worrying, especially if we consider that the US dollar index has a substantial amount of upside potential if it blows past the 2020 highs. The next few days will be critical for sentiment.