Market Brief

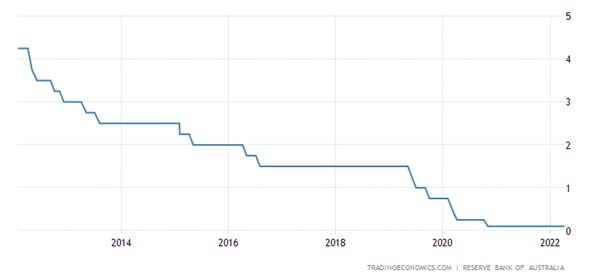

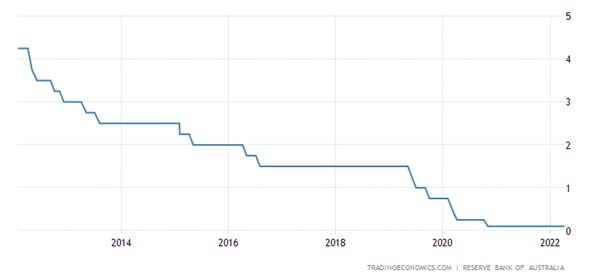

During the overnight session, the Reserve Bank of Australia (RBA) announced it would not adjust monetary policy in April. Both the cash rate and the three-year Australian Government Securities (AGS) bonds will remain at 10 basis points, unchanged from last month. Higher commodity prices are also supporting growth and macroeconomic policies remain supportive. Additionally, the rise in prices is putting pressure on household budgets, while the floods are causing hardship for many communities.

See real-time quotes provided by our partner.

The ActivTrader sentiment indicator shows a growing short position which as a contrarian indicator suggests that the price of AUDUSD will go higher until this cohort is stopped out.

Higher commodity prices obviously help the bulk of the Australian economy so even though inflation is hurting the average Australian consumer it is basically a transfer of wealth to the corporations. Which will keep the Aussie supported for longer, especially if the RBA must prepare for a rate hike in the future.

“The Board has wanted to see actual evidence that inflation is sustainably within the 2 to 3 percent target range before it increases interest rates,” said RBA Governor Philip Lowe. “Over the coming months, important additional evidence will be available to the Board on both inflation and the evolution of labour costs.”

See real-time quotes provided by our partner.

Senate Majority Leader Chuck Schumer announced last night that Republican and Democratic negotiators had reached a deal on the latest round of emergency funding for COVID-19. $10 billion will be allocated to agencies within the Department of Health and Human Services under the newly proposed ‘Preparedness Package’. This smaller version of the bill came after the White House requested $22.5 billion in pandemic aid in March. “This $10 billion COVID package will give the federal government and our citizens the tools we need to continue our economic recovery, keep schools open and keep American families safe,” said Schumer.

See real-time quotes provided by our partner.

The Nasdaq along with the US equities pushed higher on positive sentiment and the news about Elon Musk’s stake in Twitter. The bonus of an extra $10 billion going directly into the economy along with increasing bank lending will keep the indices going higher too.

The DXY ended yesterday at the highs and near the top of the recent range as $99 once again acted as resistance. The momentum is to the upside, so I am waiting to see if the DXY can get above the recent swing high before tomorrow’s FOMC meeting minutes.

See real-time quotes provided by our partner.

Traders are anticipating a string of data reports on the services sector from Germany, the Eurozone, and the United Kingdom this morning. Global attention continues to be focused on the conflict in Ukraine and its economic consequences. We should expect volatility from news headlines but there are very few more market-moving data points scheduled into today’s calendar. Later this afternoon the market will look to the US ISM Services PMI data and Fed’s Brainard speech before FOMC member Williams speaks in New York late in the day.

If the European data comes out worse than expected or we get a worsening scenario in Eastern Ukraine we could see the EURUSD fall which again will support the DXY. The MACD is showing momentum dropping but the price action needs to make a lower swing low at least for trend traders to add to their positions.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.