Market Brief

See real-time quotes provided by our partner.

The volatility index is rising still as Ukraine situation worsens. During the Asia-Pacific session stock markets traded lower as the crisis between Ukraine and Russia continues to escalate and impact the global economy.

The Russian government proposed a ceasefire in five cities in Ukraine to open evacuation routes. So far, the Kremlin has opened five potential humanitarian corridors to the Ukrainian 1. According to Haruhiko Kuroda, Governor of the Bank of Japan, tightening monetary policy and reducing stimulus is not appropriate currently. It will be interesting to see the reaction in the markets if the Fed backs out of their highly anticipated policy change. Further sanctions against Russia were imposed by the Australian government and this evening after the forex markets close there is a scheduled speech from RBA Governor Lowe.

See real-time quotes provided by our partner.

The Nikkei225 has dropped -1.71% and is currently trading into an imbalance zone. My personal view is the momentum will cut through the next 1700 points to the 23000 level. Daily EMAs are all pointing lower, and momentum is going to push the price action.

The ActivTrader sentiment indicator shows that 83% of traders trading the FTSE100 are long. As always these signals to me that there could be a push lower.

See real-time quotes provided by our partner.

The FTSE100 is being dragged down by the same forces that are pulling the US stock markets lower. The recent break of a trendline appears to have been tested and rejected by yesterday’s price action so I will be looking to see what the momentum does at the high or low from yesterday should they get tested.

See real-time quotes provided by our partner.

Gold reached the level of resistance I pointed out yesterday. Would be amazing if this was the top and we did get a drop down to $1677.97 /oz. However, unless something fundamentally changes this is very unlikely. Talks of Central Banks backing their currencies with gold, the traditional store of value and as an inflation hedge is keeping the yellow metal in an uptrend. Investors looking to diversify and move out of equities will need an asset like gold which is liquid to hold as collateral.

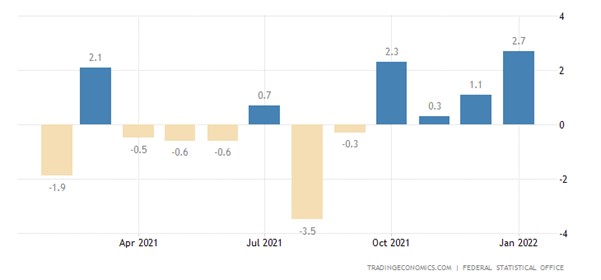

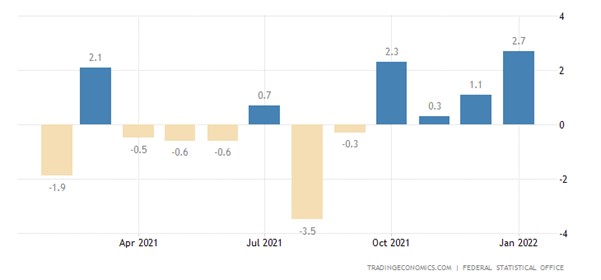

Following a revised 1.1% increase in December, industrial production in Germany increased 2.7% mom in January of 2022, surpassing market forecasts of a 0.5% increase. A mild winter helped increase industrial production at its highest level since October of 2020.

See real-time quotes provided by our partner.

The EURGBP is on the rise and has poked back above the previous level of support from 2020. Whether it is due to the SNB buying euros and selling their francs, or whether it a combination of good German industrial production and a ceasefire in Ukraine, we should be on the lookout for a rejection of the dynamic resistance from the EMAs. I would look for a bullish reversal only after a break of the 0.84680, which would be a significant high.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.