During the upcoming trading the US consumer price inflation release is set to dominate the economic docket after last week’s very strong Non-farm payrolls job report. The main event of the week, the US CPI release, is the last before Jackson Hole, where the FED are tipped to announce QE tapering.

Other key macroeconomic releases to watch out for this week include the United Kingdom second-quarter GDP report, and the release of the Michigan Consumer sentiment index.

This week will also see the release of harmonized CPI inflation numbers from the German economy, and CPI inflation data from the world’s second largest economy, namely China.

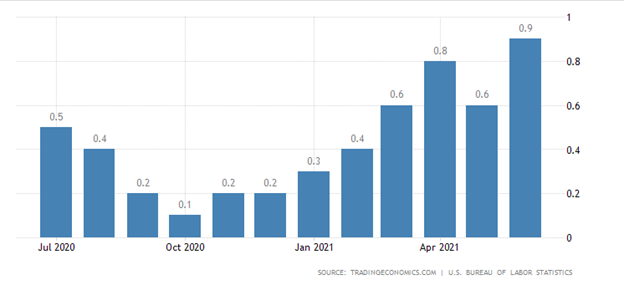

US Consumer Price Index

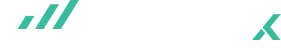

The highlight on the economic docket this week is without a doubt going to be the US CPI release, following the release one of the strongest inflation numbers the American economy has ever seen last month.

Last month the Consumer Price Index in the United States increased 0.90 percent in June which was well above market forecast of 0.5 percent. This was the largest monthly rate since June 2008.

The CPI index for all items less food and energy rose 0.9 percent in June after increasing 0.7 percent in May. Many of the same indexes inside the report continued to increase, including used cars and trucks, new vehicles, airline fares, and apparel.

Most economists are expecting a 0.5 percent in US CPI last month, which would probably be taken as a positive sign by the market, due to the fact that many analysts are fearing that the FED have misjudged inflation pressures.

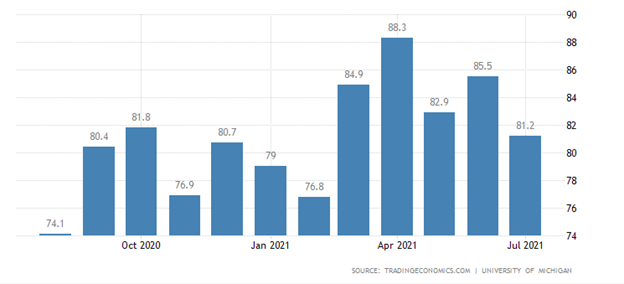

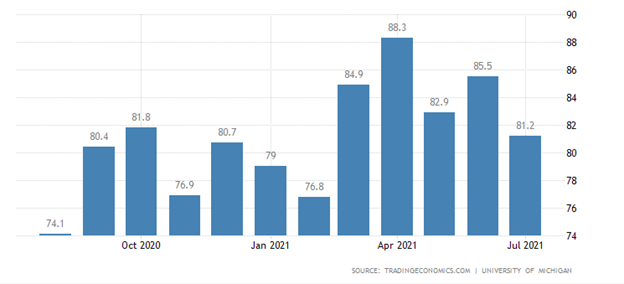

US Consumer Sentiment

The University of Michigan’s consumer sentiment is closely watched by market participants as it gives an accurate depiction of the average mood and conditions of business conditions in the world’s largest economy.

Last month reading was revised higher to 81.2 in July of 2021 from a preliminary of 80.8, although still remaining the lowest reading in 5 months. The fall in consumer sentiment last month troubled stock markets, so another big decline would worry investors.

It should be noted that last month the largest monthly declines remained concentrated in the outlook for the national economy and complaints about high prices for homes, vehicles, and household durables.

While most consumers still expect inflation to be transitory, there is growing evidence that an inflation storm is likely to develop on the not-too-distant horizon. This month’s reading is expected to come in slightly above last month, around 82.0.

UK Q2 GDP Report

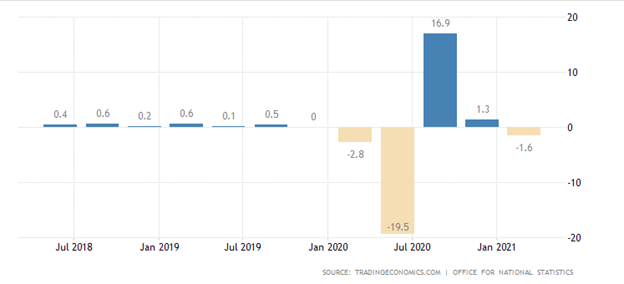

UK Gross Domestic Product data is expected to show that the UK economy came out recession, although narrowly, as the timing for the end of the second quarter coincided with the end of most coronavirus restrictions, meaning that the UK was nowhere near its full growth potential.

The summer months are expected to give spending a leisure a big boost, although it should be noted again that the UK economy is nowhere near firing on all cylinders at the moment and the so-called “pingdemic” could have hampered growth in July.

Last month gross domestic product shrank by 1.6 percent on quarter in January to March 2021, revised from the first estimate of a 1.5 percent fall and ending a two-quarter period of growth.

There were declines in both household consumption and business investment, as a result of the reintroduction of COVID-19 restrictions, while government expenditure increased at a slower pace.

If the UK posts a much worse growth number then sterling could see a short-lived meltdown as consequence, and the FTSE100 could take a hit if a double-dip recession is confirmed.