Sentiment towards a number of key trading instruments is starting to shift amongst the retail crowd this week. When large one trading basis form it often helps give sentiment traders an informed opinion about the directional basis of non-professional traders.

Actually, fading or doing the exact opposite of what retail traders are doing is a viable trading strategy and has been for some time. This is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be peaking, and about to reverse at any time.

Neutral reading typically indicate indecision or point to more range bound conditions, while sudden shifts in sentiment can potentially mark trend reversals. With that said, I will now look at some the strongest sentiment trades amongst the retail crowd right now.

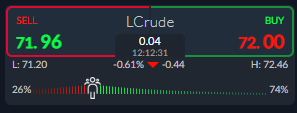

Crude- Bearish Warning

According to the ActivTrader Market Sentiment tool some 74 percent of traders are currently bullish towards crude oil despite fears over the Delta variant and apparent indecision and conflict amongst key OPEC members.

Given that a bearish double-top pattern is in place and Crude oil has staged a major pullback from $75.00 this week it maybe it may be fair to say that bulls should be nervous. Even more so given the huge price run up over recent months.

The growing sentiment skew suggests that crude oil could be due for even more of a downside correction. If bullish sentiment grows and crude oil continues to grow if could create a spiral effect to the downside, however, we must remember that the overall trend is still bullish.

EURGBP – Counter Trend

The ActivTrader market sentiment tool shows that traders are very bullish towards the EURGBP pair at the moment, with 85 percent of traders expecting further gains in the traditionally slow moving and highly trend-based currency pair.

EURGBP has recently broken below a key long-term trendline and looks doomed to further declines on the technical front. Furthermore, sterling is starting to show signs of bullishness after a recent spell in the doldrums.

We should also consider that the overall trend is bearish, not just the short-term trend, which is likely to hold negative while the pair is capped under the 0.8650 mark. Overall, beware running counter trend to this pair.

VIX– Volatility Wipeout

Market sentiment towards the VIX is hugely one-sided right now, with the ActivTrader Market sentiment tool showing that some 97 percent of traders are bearish towards rising volatility in the market.

Such a large one-way trading skew rarely ends way, and such is the size of the sentiment bias that a massive, short squeeze could take hold at any moment if market volatility starts to pick-up this summer.

It should be noted that the summer months are traditionally very dull, and the markets may not come to life until the Autumn. However, joining the crowd and being short volatility seems like a very risky bet.