During the upcoming trading week global central banks and consumer price inflation releases are set to dominate the economic docket. The main event of the week will be the US CPI release, however, central bank decisions from the Bank of Japan, Bank of Canada will also be very important for currency and stock traders.

Other key macroeconomic releases to watch out for this week to watch include FED Chair Powell’s testimony before US Congress, United Kingdom Consumer Price Index numbers, and the Reserve Bank of New Zealand interest rate decision and policy statement.

This week will also see the release of harmonized CPI inflation numbers from the German and Australian economies, United Kingdom jobs data, and the monthly jobs report from the Australian economy.

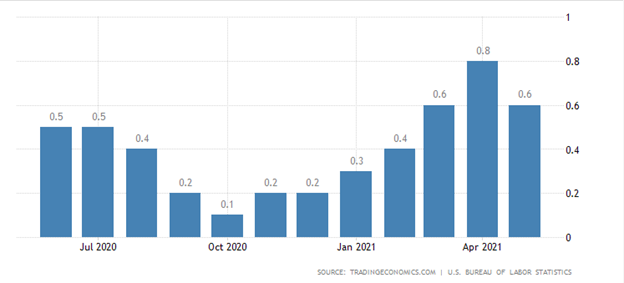

US Consumer Price Index

The highlight on the economic docket this week is without a doubt going to be the US CPI release, following the release of some of the strongest inflation numbers the country has seen in over decade during the last fiscal quarter.

Some market participants have noted that the FED’s worst case scenario would be a low growth and high inflation environment, and I tend to agree with this assessment. This month’s CPI increase is expected in at 0.4 percent, which is not as high as last month and means CPI is trending lower for a second consecutive month.

Last month’s Consumer Price Index increased by 0.6 percent on a seasonally adjusted basis after rising 0.8 percent in April. The index for used cars and trucks continued to rise sharply, increasing 7.3 percent in May and accounting for about one-third of the seasonally adjusted all items increase.

The food index increased 0.4 percent in May, the same increase as in April. The energy index was unchanged in May, with a decline in the gasoline index again offsetting increases in the electricity and natural gas index.

No major surprises are expected this week, and it will particularly be interesting to see what the FX and bond market does after the FOMC release, especially after last Friday’s reaction to the NFP headline number. Traders should expect more of the same this month, albeit to a lesser degree.

RBC Rate Decision & Policy Statement

The Bank of Canada interest rate decision is a real will they or will not they moment for the market as an increasing number of market participants expect the BOC to be the first major central bank to raise interest rates.

During the previous meeting, the central bank left its key overnight rate unchanged at 0.25 percent as expected, and the quantitative easing program was also kept at a target pace of $3 billion per week, following a C$1 billion reduction in May.

The central bank said last month that there remains considerable excess capacity in the Canadian economy, and that the recovery continues to require extraordinary monetary policy support. So given the relative uncertainty surrounding global growth and volatile Canadian jobs market the bank may be in wait and see mode again this month.

Given last month’s strong 200,000 plus headline number and the fact that oil prices remain buoyant it is likely that the central bank are going to strike a hawkish tone and may outlay the need to raise rates.

UK CPI Report

Inflation is going to be a big topic for sterling traders this week as they face CPI numbers from both sides of the pond, at a time when inflation is arguably the number one topic in financial markets.

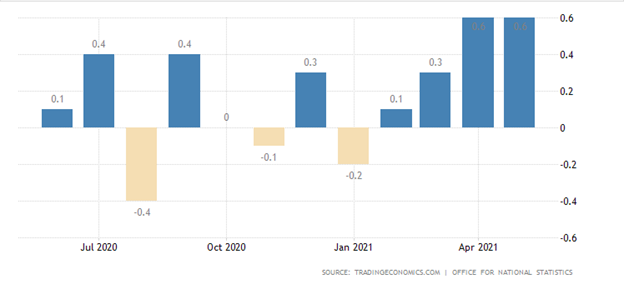

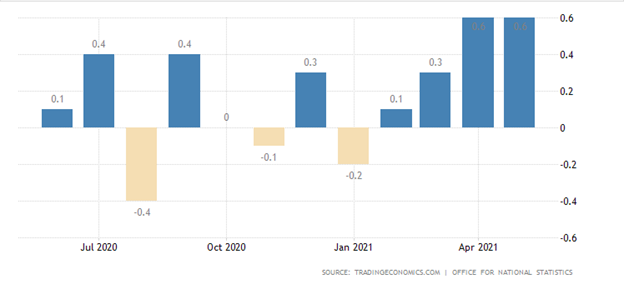

The Consumer Price Index in the United Kingdom increased 0.6 percent from a month earlier in May 2021, advancing at the same pace as in the previous month, and beating market expectations of a 0.3 percent increase.

As the United Kingdom faces supply constraints after Brexit and backlogs of orders build up from worldwide shipping issues it seems likely that the UK economy will have experienced another strong monthly increase in CPI inflation. This is ultimately bullish for the GBPUSD pair.

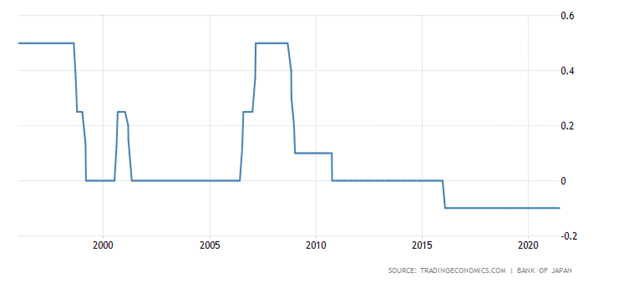

BOJ Rate Decision & Policy Statement

This week’s BOJ rate decision and policy meeting could be more impactful than most traders and investors are thinking, due to the fact that the central bank is likely to admit that growth is dwindling, and inflation is rising.

Yen weakness could be on the cards after this week’s meeting if the BOJ admits that the Japanese economy is in a dire state due to the ongoing national emergency and the banning of spectators from the Olympics.

Japan has spent vast amounts of money on the Olympics, and now tourists and visitors are not allowed to watch the game in person it could be speculated that the economic damage could be significant.

Last month the Bank of Japan left its key short-term interest rate unchanged at -0.1 percent and maintained the target for the 10-year Japanese government bond yield at around 0% percent. The central bank also extended by six months the September deadline for its pandemic-relief programme.

Aside from dovish commentary no new change is expected, however, the reaction of Japanese stocks and also the Japanese yen currency will be fascinating on many levels if traders start to factor in a clear divergence between the BOJ and other major central banks.