During the upcoming trading week, the release of the United States Non-farm payrolls job report is set to be the main focus for financial markets, following last month’s worse than expected 559,000 headline number.

Other key highlights on the economic docket this week include the closely watched ISM manufacturing report from the United States, and key retail sales from the German economy, which is Europe’s largest.

This week will also see retail sales and CPI inflation numbers from Europe, Gross Domestic data from the United Kingdom, and manufacturing data from the Japanese and Chinese economies.

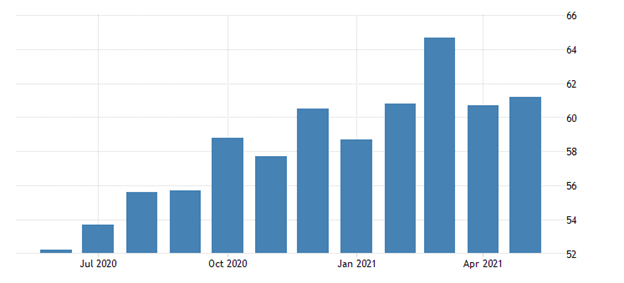

ISM Manufacturing Report

Analysts are expecting another strong ISM manufacturing report June, with a 61.0 number being touted as the most likely outcome this week. The ISM Manufacturing PMI rose to 61.2 in May of 2021 from 60.7 in April.

If we look at last month’s data, new orders came in red hot and the backlog of orders accelerated, while inventories largely rebounded. Manufacturing employment was at the lowest level since November, and price pressures remained elevated.

In reality the manufacturing recovery in the US has transitioned from first addressing demand headwinds and to now overcoming labour obstacles across the entire value chain. The bottom line is markets are expecting more of the same this week.

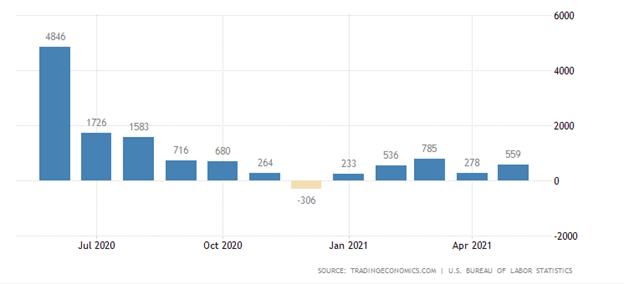

Non-farm Payrolls Job Report

Traders will be highly anticipating the Non-farm payrolls job report this week, with many analysts predicting that the United States economy created 600,000 new jobs in June, which is a slight improvement on last month.

Investors will be nervous as weekly jobless data is rising in the United States, which is making the jobs recovery even more uncertain and the NFP jobs report very hard to predict. This is also making it more difficult for the FED to taper QE, and the remains the key for the direction of the greenback.

Should we see a number much greater than 1,000,000 then traders and investors will be speculating that the FED could soon be discussing tapering. Expect the US dollar to go into meltdown mode if the jobs number comes in under 200,000. This would be a big concern for US dollar bulls and gold bears.

German Retail Sales

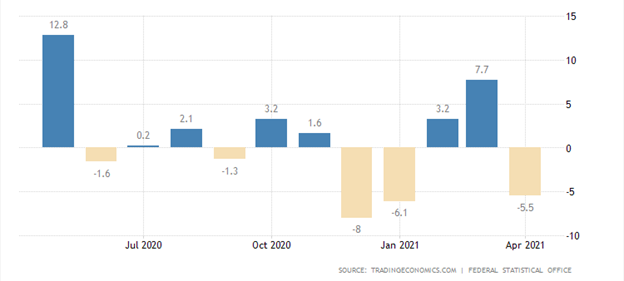

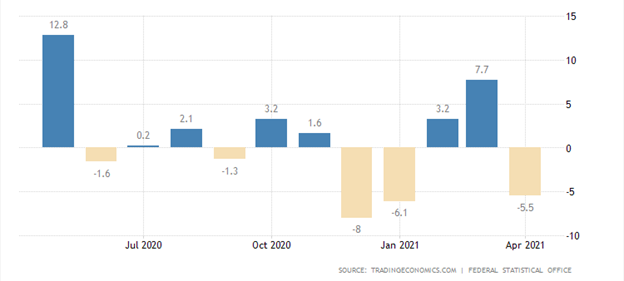

Retail sales in Germany are expected to have fallen by -2.2 during the month of May. This is not a terrible number as retail sales in Germany contracted by 5.5 percent month-over-month in April. The expected number could highlight that the economy is gradually recovering.

It should be noted that retail sales for Germany are very lagging as the data released is almost two months behind the current date of release, which almost certainly effects the market reaction.

Better retail sales should be expected if we look at recent confidence data from Germany and also the robust ZEW and IFO survey numbers, which generally paints a more positive picture for the German economy and a consumption led recovery.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.