Morning Brief: 19/04/2021

New surrounding the Biden administrations $2 trillion spending bill is starting to move the needle this morning, as reports suggest that some Republican senators are ready to accept a lower infrastructure spending bill from the Democrats.

Some market reaction has taken place to the news, with the EURUSD pair falling, and US futures stock initially dropping on the weekly open. The futures markets have stabilized somewhat as some sources familiar with the Biden administration note that President Biden is willing to accept a smaller corporate tax increase in order to get the spending bill signed-off.

See real-time quotes provided by our partner.

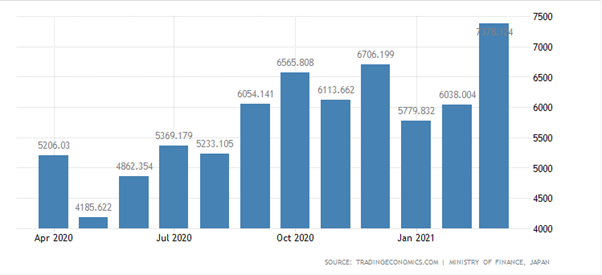

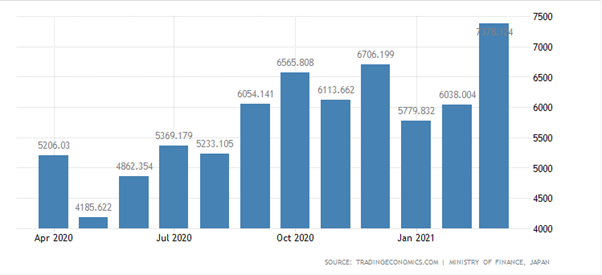

Data released earlier this morning showed that Japanese exports surged by +16.1 percent, which far exceeded markets expectations. Looking deeper inside the data it can clearly be seen that a sharp increase in exports to China largely contributed to today’s positive data point.

In reaction to the news the Japanese yen currency and Nikkei225 index are firming this morning. It should also be noted that geopolitical tensions are still high between the US and Russia, and China and Taiwan, so the Japanese yen is a natural safe haven.

Bitcoin had a hugely volatile weekend and dropped by around $10,000 from the Saturday’s trading high, and nearly $14,000 from its current all-time high, of $54,900, which happened on the day of the Coinbase IPO last Wednesday.

The reason behind the big drop was numerous, including regulatory concerns surrounding the US Treasury and a power outage in China. So-called Bitcoin whales are also cited as being behind the steep price drop over the weekend. And Turkey also banned crypto payments last weeks.

Goldman Sachs has put out a note this morning stating that it is time to buy the euro currency. An analyst from the investment bank thinks that the EURUSD is headed towards 1.2500 and has a 12-month target of 1.2800.

See real-time quotes provided by our partner.

Gold is holding in breakout territory this morning. Reports started to circulate over the weekend that the Chinese government is allowing some companies to stock up on gold additionally hedge funds are reporting in gold accumulation phase once again.

Data Watch

The economic calendar in the European session is very light today, with eurozone construction data and the Buba report from the German economy the main data focuses ahead of the ECB policy meeting this Thursday and Friday’s preliminary PMI releases from Europe.

During the United States trading session shorter dated bonds auction from the United States and housing data from the Canadian economy will be the main focuses. Canadian dollar traders will be looking for strong number ahead of Wednesday’s Bank of Canada policy meeting.

Market participants are probably going to be looking for confirmation about the Biden administrations spending bill and tax increases, following reports over the weekend that changes are afoot.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.