Morning Brief: 16/04/2021

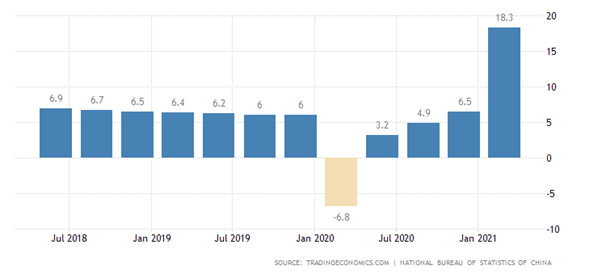

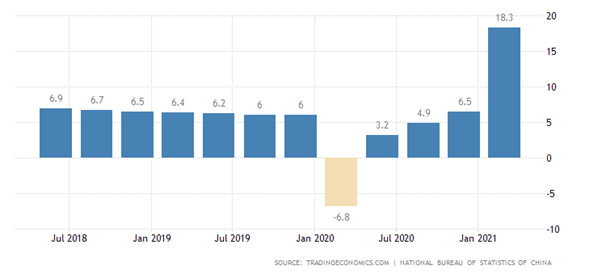

Data released earlier this morning showed that China, the world’s second-largest economy, grew at a record 18.3 percent during the first quarter of 2021 compared to the exact same period last year.

Market optimism towards the solid Q1 number is currently high, with many Asian index’s trading in the green, due to the fact that today’s GDP number was the biggest bump in growth since Chinese records began in 1992.

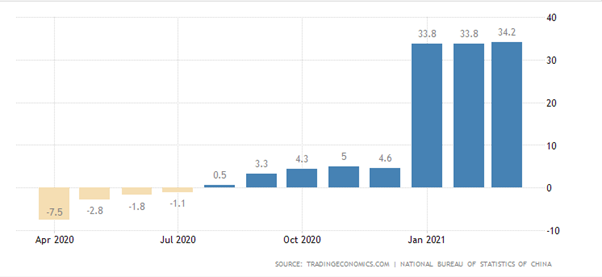

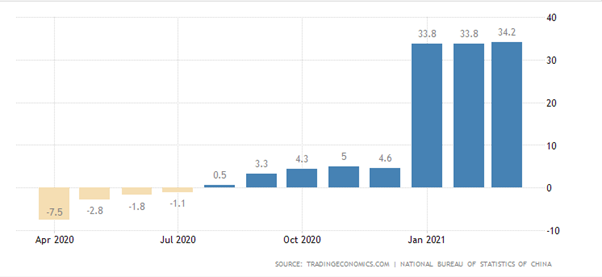

Chinese retail sales data further complimented the notion that Chinese Q2 growth is going to be robust, as year-on-year retail sales numbers for the month of March came in at +34.2 percent.

Antipodean currencies, such as the New Zealand dollar and the Australian dollar, are often seen as proxies for risk-on sentiment are also on the advance. Both nations have strong trade ties with China, particularly in the commodity space.

Aside from China, Turkey is in the news this morning, but for very different reasons. Turkey has banned cryptocurrency payments in attempt to shore-up the nation currency after the Turkish Lira recently plunged.

Cryptos are not liking the news this morning and are heavily in the red. Bitcoin has fallen by nearly $2,000 on the news. Fears amongst crypto holders may be growing that other countries may follow suit.

The US dollar is starting to fight back after yesterday’s strong US retail sales report. The EURUSD and the GBPUSD pair are notably lower after losing upside momentum following the strong 9.8 percent retail sales number and steep drop in weekly jobless data from the United States.

Gold and silver prices have broken out to the upside, despite the US dollar comeback. The yellow-metal now may be looking towards the $1,810 technical area, while silver is back above its 200-day moving average.

The FTSE100 is testing towards the 7,000 level this morning, and looks set to explode, as euphoria towards the UK coming out of lockdown is driving UK sticks. The FTSE250 moved to a new record high this week as blue-chip companies lead the advance.

Data Watch

The economic calendar in the European session is heavily focused on EU CPI inflation data. CPI is expected to come in around 1 percent, which is well below the European Central Banks target of 2 percent.

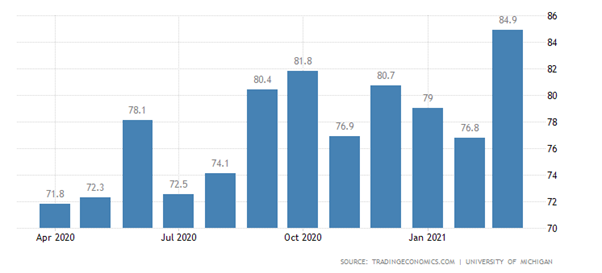

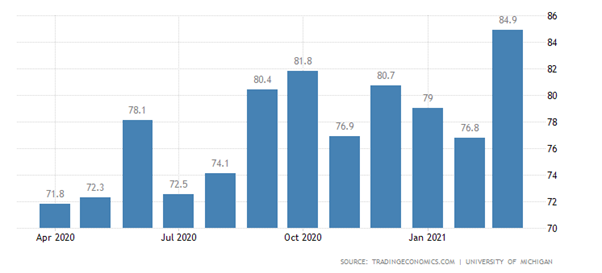

During the United States trading session the release of US Consumer Sentiment is set to headline. A strong number is predicted as the US consumer is currently in a buoyant mood after yesterday’s retail sales number.

Market participants are still focusing on buying stocks in the US as a number of FED speakers came out on the wires yesterday and talked down the recent set of red hot data points from the US economy.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.