The US dollar has continued to weaken against most major currencies during the Asian trading session, after sentiment towards the greenback took a hit after the muted February CPI inflation report from the US economy yesterday.

US bond yields have been ticking down ever since, and especially after the soft 10-year Treasury auction during yesterday’s US trading session. The Nasdaq is trucking higher in early futures, marking a nine-hundred points recovery from the lows of the week as yields falter.

Traders and investors are rightly anxious about whether the recent move higher in the US dollar index will stick around as a theme or if this week’s down move is the start of something more ominous for the greenback.

Australian bank Westpac is expecting that US dollar weakness will be around for some time, the bank notes “The US dollar gained ground this month on a growing expectation that the US economy will lead the global recovery in 2021. The underlying catalyst of this circa 1.0% partial reversal of the DXY’s prior 12% depreciation since March 2020 is the safe passage of President Biden’s stimulus package through Congress, a package that equates to almost 10% of GDP.”

The bank added “Not only have inflation expectations moved near the FOMC’s 2.0%yr medium-term target, but real yields have also begun to rise back towards zero. Whether the US dollar rises further from here or recommences its year-long downtrend will depend on whether the US’ economic performance proves comparable to or stronger than that of its key trading partners.”

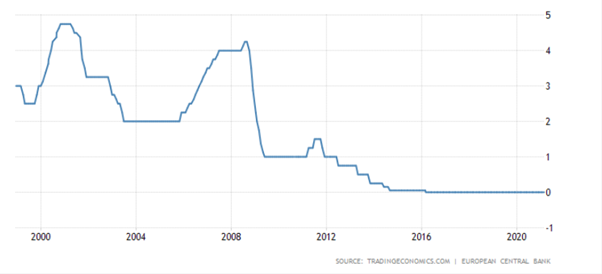

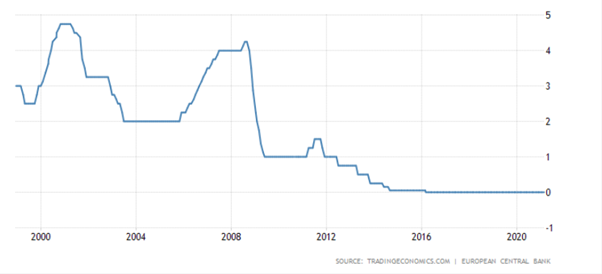

Today’s ECB meeting is expected to be another big event for the US dollar. With the EURUSD approaching the former yearly low, around 1.1950, the markets mood is finely balanced.

Sterling is also on the rise, and the British currency is likely to take its cue from whatever the euro does later today. The correlation between euro and British pound weakness has been breaking since the EURGBP broke under 0.8800 earlier this year, however, it could start to pick-up if the greenback continues last week’s down move.

Another interesting trade is the USDCAD. The Canadian dollar has strengthened since yesterday’s Bank of Canada meeting, and more so since the US dollar started bleeding lower in Asia.

Today’s OPEC meeting will be crucial for the USDCAD pair. The OPEC monthly report or MOMR should shed some light on what the top players in OPEC are thinking about production cuts in play from key oil producers such as Saudi Arabia and Russia.

Data Watch

During the European trading session, the economic calendar is notably light, with most of the market likely to be in paralysis until the ECB interest rate decision and policy statement is announced during the start of the US session.

This will be the first European Central Bank meeting since members of the ECB Governing Council came out and talked the euro down. The single currency has weakened since this took place, which was surely the primary goal.

Questions remain whether Lagarde will touch on this today, and if the recent depreciation in the euro currency is enough to get Europe’s exporters out of trouble as the fragile recovery attempts to gather momentum.

Markets also look to a key speech from US President Biden, JOLTS Jobs data, and of course the weekly jobs numbers from the United States economy.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.