Morning Brief: 09/03/2021

China’s State Funds have reportedly stepped into the market this morning to buy stocks, following a big sell-off in most of Asian bourses earlier this morning, due to fears that the Federal Reserve will be taking away monetary stimulus sooner-than-expected as the US economy recovers.

The CSI300 index was trading down by nearly 3 percent until China’s State Funds stepped in and bought stocks. Market sentiment has seen a big turn around since the intervention, with many of the top Asian indexes turning back into positive territory.

US futures are also in the green after yesterday big sell-off. The Nasdaq and S&P 500 are trading up close to one percent after the Democrats noted that they expect the stimulus to be signed into law on Wednesday, bringing the prospect of stimulus, and $1,400 stimulus checks ever closer to hitting the US economy.

Additionally, Treasury Secretary Janey Yellen said that the FED had the tools to deal with inflation and that the upcoming stimulus package would not result in a great amount of new inflation in the US.

Discussing inflation, via an interview with MSBC on International Women’s Day, Yellen noted “I really don’t think that is going to happen. We had a 3.5 percent unemployment rate before the pandemic, and there was no sign of inflation increasing”.

The USDJPY has been the big mover in the foreign exchange market during the Asian session, as the pair broke above the 109.00 handle as it continues its blockbuster move higher. The up move looks to be gaining momentum, especially since the US dollar index broke out on Thursday.

US Treasury yields are starting to retreat during the Asia trading hour, following the turn around in risk sentiment. The inverse relationship between risk-on and Treasury yields has become increasingly pronounced over recent days.

Bitcoin has been another big mover during the US trading session, following a strong up move $3,000 move towards the $54,000 level. The notion of US citizens spending their stimulus checks on BTC is underpinning the bid tone in the top crypto this week.

Data Watch

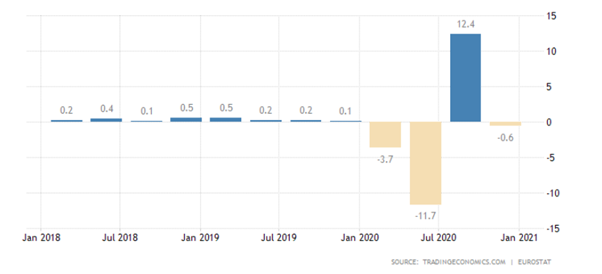

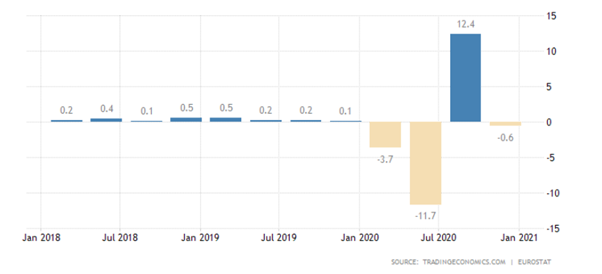

Gross Domestic Product data from the eurozone headlines the economic docket during the European trading session alongside quarterly unemployment data. The market is expecting a -0.6 percent GDP number for the fourth quarter and 0.3 percent change in unemployment.

Data during the US session is fairly muted, although the API Weekly Crude report could be a market mover for WTI and Brent oil. The market is not short of themes to focus on, so expect plenty of volatility in stocks and bonds as the market continues to react to expected stimulus package being signed into law tomorrow.

RBA Governor Lowe is giving a scheduled speech shortly after the closing bell on Wall Street. The Australian dollar could be a big market mover if Governor Lowe sounds more hawkish or dovish than the market is expecting.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.