The price of gold has fallen back towards the yearly lows, as rising 10 and 5-year US bond yields caused traders to dump the yellow-metal and move into riskier asset classes and industrial metals, such as copper.

Gold briefly recovered above the $1,800 level this week but generally suffered from a lack of demand. The move higher from $1,860 was clearly seen as technical, as traders may have been retesting some important levels and supply and demand spots.

Better-than expected US economic data on Thursday also helped intensify the price drop in gold. The general consensus is that the United States and global economy is starting to exit the darkest months of the pandemic.

Looking more deeply at the ongoing rally in commodities, it is unclear how gold fits into this dynamic. Gold could suffer severely if the Federal Reserve hint that they may stop QE purchases this year, while other metals, like copper, may benefit.

Non-yielding metals, with very little use in domestic appliances and goods, could get crushed in the reflation trade. Tension is certainly building towards gold as the metal faces its weakest period of price activity since March last year.

The saving grace for the metal in the near-term could be the US stimulus package. A key vote on the proposed $1.9 stimulus bill is set for tomorrow. The metal could receive a nudge higher if the bill is passed into law.

Additionally, the FED may need to step in to cool the bond market yield rise. They could have bullish implications for gold if markets believe that the Federal Reserve will be unable to withdraw its bond-buying programme.

Traders and investors will also be factoring in where the stimulus checks will be going. Will American citizens be buying Bitcoin or gold? I suspect we could see a bit of both, and this could be supportive for the metal in the near-term as well.

According to the ActivTrader Market Sentiment tool traders are still overly bullish towards gold with sentiment nearly 72 percent positive. I have concerned that traders are still complacent about the recent price decline and are blindly buying the dip.

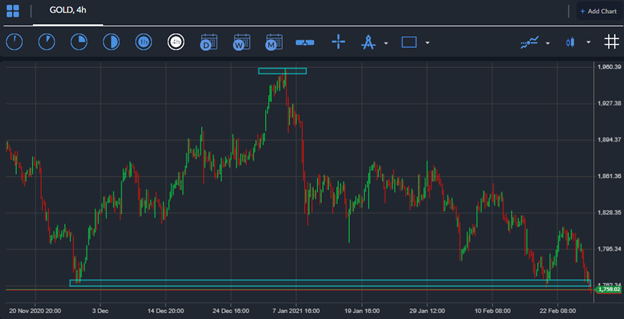

Gold short-term Technical Analysis

The short-term technicals for gold show that a large head and shoulders pattern continues to unfold, with the latest bounce towards the $1,815 level helped to form the final right-hand shoulder to complete the pattern.

Traders will be closely watching the $1,760 level as it is the neckline of the bearish pattern. Weakness under the $1,760 level could the final nail in the coffin for gold, with the $1,700 and $1,660 levels then coming into focus.

Source by ActivTrader.

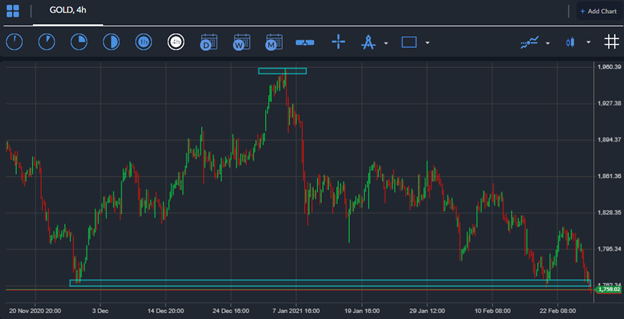

Gold Medium-term Technical Analysis

According to the daily time frame now may not be the time to buy gold. The yellow metal is still trapped inside a falling price channel, between the $1,845 and $1,650 levels, with bears targeting the bottom of the channel

We could see buyers step in towards the bottom of the price channel, around the $1,650 level. Weakness under the $1,760 level could be another major signal that bears are indeed going to target the bottom of the channel.

Source by ActivTrader.

Something else to note is the bearish death-cross is currently underway. A death-cross takes place when the 50-day moving average crosses over the 200-day moving average. This is a very negative sign.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.