The UK 100 closed above the 6,600-level last week, following news that the United Kingdom missed falling into a double-dip recession after UK GDP outperformed and the COVID-19 infection rate, commonly known as the R rate, observed a large drop.

Pharmaceutical companies led the gains on the FTSE 100 last Friday as it was shown that the quick roll-out of the vaccine was starting to have an effect on COVID-19 infections. Traders were bullish towards UK pharmaceutical stocks, especially COVID-19 vaccine stocks, as high success rates could lead to other countries starting to import the UK made vaccines.

Digging deeper into the drop in the R rate, British PM Boris Johnson also came out on the wires and suggested that the government is working on an exit strategy from the ongoing lockdown for April. This was seen as being bullish for UK economy, and hence why many stocks on the FTSE 100 closed higher on Friday.

Mining stocks were a drag lower on the FTSE 100. However, the overall outlook for miners looks bullish, especially with the recent supply glut for copper and silver. Stimulus from the US is also seen as being bullish for mining related stocks during this quarter.

Traders are now factoring in that the UK economy may start to return to growth during the next quarter. This is in-line with recent bullish commentary from the Bank of England, with many MPC members giving extremely hawkish comments towards the UK economy in a post-lockdown scenario.

Something else to watch this week is the S&P 500 and the Dow Jones Industrial Index. The FTSE 100 tends to catch a cold when US stocks turn lower, hence why it is so important that US stocks continue to rise, as this will help lift the FTSE 100.

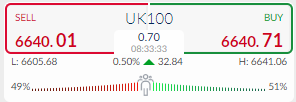

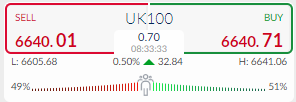

UK100 Sentiment Analysis

The Market Sentiment indicator on the ActivTrader platform currently shows that some 51 percent of traders are bullish towards the FTSE100 right now. Bulls were on the right side of the trade last week, and this week the overall upside skew is not very significant.

I expect that the FTSE 100 may need to correct lower before it heads higher again. The Market Sentiment tool typically telegraphs when big trends are about to start by highlighting extremely large one-way basis.

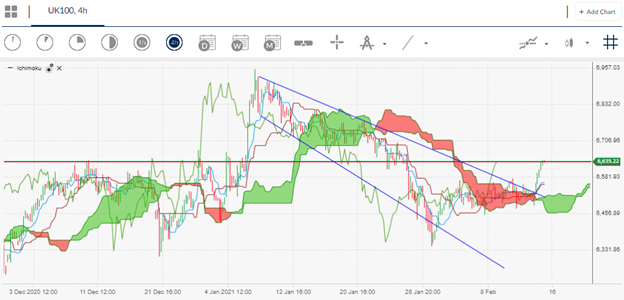

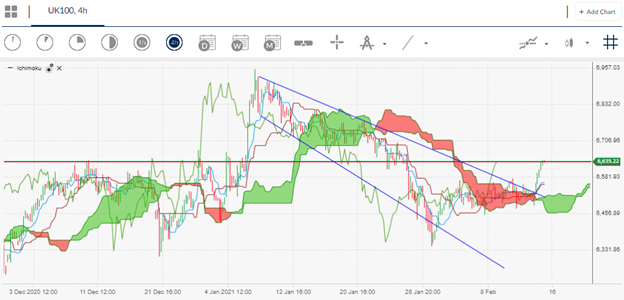

UK100 Technical Analysis

Lower time frame analysis shows that the FTSE 100 has broken above a bullish falling broadening descending wedge pattern. These types of wedgepatterns are amongst the most bullish reversal patterns that you can find on the charts.

Source by ActivTrader

According to the overall upside price target of the mentioned broadening wedge pattern the FTSE 100 can rally back towards the highs of the year, around 6,965. This will also form a huge bullish reversal patten. This scenario will be negated if the price moves below the 6,485 level.

Medium-term analysis is also bullish and continue to show the FTSE100 trapped inside a huge rising price channel between the 5,750 and 7,250 levels.I am execting bulls to attack towards the top of the price channel at some point. Gains above the 6,965 level could start the bull party towards 7,200.

Source by ActivTrader.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.